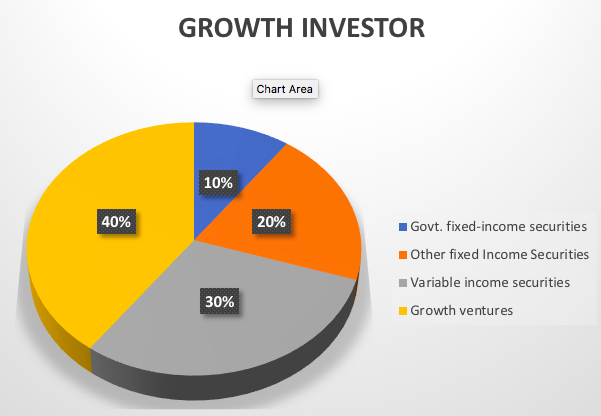

Growth Investor

What is this person saying?

‘I want the value of my asset to increase.’

You are an investor with a strong bias towards investments with high growth potential. You are willing to accept higher fluctuations in performance, in return for potentially higher long term capital growth.

You also have a greater focus to leverage your money to significantly improve growth in it’s value in the future.

This investor seeks increase in value capital appreciation or/and compounded returns.

This investor is prepared to accept greater portfolio losses over a long period in an attempt to achieve higher growth of capital.

The investor is willing to buy investments or enter into contracts that may be difficult to sell or close within a short frame or have an uncertain realizable value at any given time, which conservative or moderate investors are typically uninterested in.

The growth portfolio will have more than half of it’s allocation to investments with high propensity for growth over time. The recommended minimum investment period 5 years.

Suggested investments are those that carry significant risk but potentially significant returns(or loss) include shares of growth or start-up companies, real estate development, starting businesses, private equity, commodities, crypto currencies, real estate investing in other countries, R.E.I.TS in foreign countries, e.t.c.

Please note, the above diagram is only an example of how this investor profile could allocate resources and is not a recommendation.

Interested in learning more about this Investor profile?

Request A Consultation

Learn the pros and cons of this investor profile and how you can become a savvy investor with your money.

We Have Been Featured In: